Going Beyond Compliance in Financial Organizations

Updated May 15, 2024

Organizations often confuse the concept of being compliant with being secure. They assume that they must be appropriately protected once they have invested the necessary resources to achieve compliance. Considering that meeting compliance mandates are not cheap, averaging $3.5 million annually. Still, the cost of not meeting compliance mandates is even higher, averaging $9.5 million, according to the Ponemon Institute. In practice, this is not the case.

Compliance is vital as a foundational framework, setting a minimum standard for security controls within organizations and establishing requirements and regulations to ensure a baseline level of security. However, it takes more than compliance alone to provide a comprehensive assessment of the effectiveness of these controls. Mere compliance does not guarantee that an organization’s security measures are fully equipped to combat all potential threats. The dynamic and ever-evolving nature of cybersecurity demands a more proactive and holistic approach beyond mere compliance.

In this blog, we dig into why compliance is insufficient to meet security and how financial organizations can enhance compliance programs to protect their data and assets.

Compliance as a Baseline

Compliance focuses primarily on meeting specific criteria and adhering to established guidelines, often without considering the constantly evolving landscape of cybersecurity threats. Therefore, organizations must go beyond mere compliance and actively assess the efficacy of their security controls to ensure comprehensive protection against emerging risks. This entails conducting thorough risk assessments, implementing advanced security measures, and continually monitoring and adapting security protocols to address the evolving threat landscape.

Risk-Based Assessment

The effectiveness of security measures lies in first conducting a risk-based assessment that compares the threats faced by an organization with its existing controls. A risk-based approach is crucial in evaluating various threats’ potential impact and likelihood, using a systematic analysis considering both the probability of an incident occurring and the possible consequences if it were to happen.

Using a risk-based assessment, organizations are not just targeting every threat but instead are identifying and prioritizing the most critical risks, allowing them to allocate resources and implement appropriate controls accordingly. This approach enables organizations to focus on mitigating the threats that pose the most significant potential harm and align their security measures with their specific risk profile. It empowers organizations to make informed decisions and allocate resources effectively to ensure that their security controls are targeted, robust, and tailored to address the most significant risks they encounter.

Limitations of Compliance in Addressing Emerging Threats

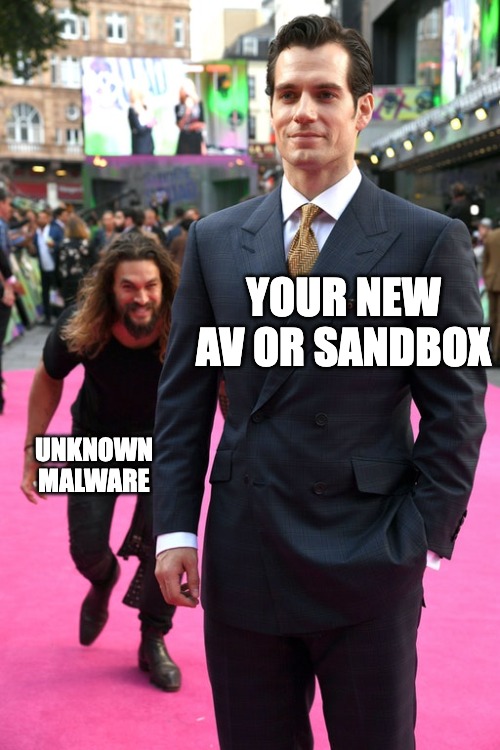

Compliance requirements play an essential role in setting a baseline for security practices, but they have limitations when addressing emerging threats. For instance, consider the compliance requirement of protection against malware, which most organizations meet by using a traditional antivirus (AV) solution. However, these solutions have inherent limitations in addressing new and unknown threats, relying on previous detections of threats in the wild for identification. Cybercriminals know this and continuously evolve their attacks, making new malware on the order of 450,000 new strains daily, making it virtually impossible for any solution to detect 100% of the existing varieties. The new malware often exploits zero-day attacks, which are vulnerabilities unknown to the software vendor or the security community. As a result, traditional AV solutions that rely on signature-based detection cannot detect and prevent such attacks effectively.

Despite achieving compliance with AV implementations, organizations must enhance their security framework to address additional vectors that attackers are exploiting. Enhanced phishing campaigns, for instance, have become more sophisticated, using AI to craft messages that mimic legitimate communications, making them harder to detect. Similarly, attackers are increasing efforts in password theft and credential stuffing, where stolen credentials are used to gain unauthorized access to sensitive data. These techniques allow cybercriminals to bypass traditional security measures, gaining a foothold within an organization to access and potentially compromise personally identifiable information (PII) and other sensitive data.

To truly secure organizational data and systems, it is essential to supplement compliance efforts with a more proactive and comprehensive approach. This includes deploying advanced security solutions that provide real-time threat intelligence and the ability to respond immediately to threats before they can exploit vulnerabilities.

What Leads to Compliance Failures

Compliance failure can occur in various ways, ranging from intentional non-compliance to incidents that result in non-compliance. Meeting the standards and best practices outlined in compliance mandates is crucial, and failing to implement them on this level is one form of failure. However, more than simply meeting these requirements is needed to safeguard against the sophisticated tactics cybercriminals use today.

One significant risk factor is the improper sharing and handling of sensitive data, such as PII, which compliance mandates strictly regulate. The potential for data exfiltration is high when breaches occur—whether through security incidents, malware, or ransomware attacks. This results in compliance failure and exposes the organization to severe legal and financial repercussions.

Direct Cost of Non-Compliance

Non-compliance with legal or regulatory requirements can lead to substantial direct costs affecting an organization’s financial performance. Non-compliance consequences can manifest in the form of penalties and fines imposed for violating specific regulations. To provide insight into the potential financial impact, here are examples of the costs that may arise due to non-compliance:

| Regulation | Maximum Penalties |

| GLBA | Up to $100,000 per violation |

| Sarbanes-Oxley Act (SOX) Individuals: | Up to $5 million |

| SOX Companies: | Up to $25 million |

| PCI-DSS | $5,000 to $500,000 (varies based on records) |

| GDPR | Up to €20 million or 4% of revenue |

| CCPA | Up to $7,500 per violation |

Indirect Cost of Non-compliance

Non-compliance with regulations and data protection standards carries consequences that extend far beyond financial penalties, significantly affecting a company’s overall market standing and financial health. A key aspect of this impact is how non-compliance shapes customer perceptions regarding the organization’s commitment to security.

A company failing to meet compliance requirements exhibits a disregard for protecting sensitive information. It signals a broader disregard for privacy standards, which can severely erode customer trust and confidence. This erosion of trust can lead to immediate losses, such as the termination of existing business relationships, and long-term damage, such as a sustained reluctance among potential new customers to engage with the company.

Moreover, the ripple effects of diminished trust from a breach can extend to the organization’s brand reputation, affecting investor confidence and possibly leading to a decline in stock prices or market value. Surveys have shown that in the US alone, 83% of consumers say they will stop spending with a business after a security incident. This is evident from research showing that 29% of companies lose revenue after a breach and a 7.5% decrease in stock price.

Identifying the Risks

Financial organizations operate in a high-stakes environment where diverse threats pose significant data integrity and security risks. These threats range from sophisticated cyberattacks, such as ransomware and phishing, to insider threats and the growing risks associated with mobile and cloud technologies. Understanding and identifying these risks is a regulatory requirement and fundamental to a robust cybersecurity strategy. Failure to address these threats can result in data exposure, compromising sensitive information, and non-compliance with regulatory requirements.

Each financial organization’s risk level is influenced by its unique IT infrastructure, which may include legacy systems alongside modern cloud-based solutions, creating a varied landscape of potential vulnerabilities. Additionally, the specific controls and security measures an organization has in place, such as encryption, access controls, and continuous monitoring solutions, significantly impact the effectiveness of risk mitigation efforts.

Internal Threats

Internal threats in financial organizations arise from insiders directly accessing sensitive data and systems, encompassing disgruntled employees who may sabotage operations out of resentment and those seeking personal gain through data theft or corruption. External entities, including organized crime groups, further leverage these internal actors, which exploit organizational vulnerabilities through bribery, coercion, or social engineering. The risks from these threats extend beyond data theft, potentially leading to data manipulation or system sabotage, disrupting financial operations, and causing extensive economic damage.

Addressing these internal threats requires robust security measures, such as strict access controls, continuous monitoring for unusual activities, and comprehensive employee training to strengthen awareness and security practices. Implementing these strategies helps mitigate the risks posed by insiders and safeguards the organization against the wide-ranging consequences of their actions, from operational disruption to severe reputational damage. You can learn more about internal threats in our blog.

Direct Attackers

Direct attackers pose a persistent and ever-present threat to financial organizations. These cybercriminals employ various tactics and techniques to exploit an organization’s infrastructure vulnerabilities and gain unauthorized access to sensitive data. The range of attackers can vary widely, from relatively inexperienced script kiddies to highly sophisticated nation-state actors or organized criminal groups. The size and complexity of the attack surface determine the level of skill and resources the attackers require. Regardless of the attacker’s profile, this threat should never be underestimated or overlooked.

The implications of underestimating these threats can be catastrophic, leading to significant financial losses, severe reputational damage, and regulatory penalties. To address direct attackers, financial organizations require advanced data detection technologies. These technologies can provide a proactive security posture, continuously monitoring and analyzing data transactions to detect and respond to real-time anomalies. By implementing these technologies, institutions can effectively shield their critical assets from the advanced tactics of direct attackers.

Hidden Threats in Files

Financial organizations know the importance of strong perimeter security measures to protect their valuable data. However, cybercriminals constantly evolve tactics, seeking alternate routes to bypass these defenses. One such method is embedding hidden threats in files, which creates a side-channel attack vector for malicious actors. By hiding threats in seemingly harmless files, cybercriminals can exploit the human factor within organizations. Employees may unknowingly open infected files, disguised as invoices, resumes, or partner materials, which can lead to the deployment of various malicious payloads such as ransomware, rootkits, or backdoors. Instead of relying on complex technical exploits, cybercriminals target humans as the weak link in the security chain.

Additionally, new threats embedded in files can also deceive the security tools and protections in place at an organization.

Phishing

Phishing attacks have become a prevalent and persistent threat in cybersecurity, particularly because they target the weakest link in the security chain: humans. These attacks aim to deceive employees into divulging sensitive information, granting cybercriminals access to valuable data and enabling them to conduct more extensive and damaging attacks. While login credentials remain a popular target for phishing campaigns, attackers increasingly seek more than basic access. They are after valuable information about internal IT systems, including technical details, vulnerabilities, and configurations.

Additionally, they may be interested in gathering knowledge about internal processes and procedures, allowing them to exploit weaknesses and bypass security measures more effectively. Another concern is gathering information on organizational hierarchy, used for whaling campaigns—highly targeted attacks against key individuals, such as executives or decision-makers.

Stopping Threats to Financial Data

A nuanced and multi-faceted approach to cybersecurity is imperative to combat the diverse threats faced by financial organizations. Rather than relying on a single control to mitigate all risks, it is essential to implement targeted controls specifically designed to address individual threats tailored to the organization’s unique risk profile and security objectives. Enhancements such as automation and co-integration of security controls significantly increase the efficiency and effectiveness of these measures. Automation streamlines processes by handling repetitive and labor-intensive tasks, thus reducing the need for extensive staffing and allowing teams to focus on higher-level security concerns.

Moreover, the co-integration of security tools and systems enhances their ability to operate synergistically, minimizing manual oversight and fostering a seamless exchange of information. This integration enables the generation of intelligent, actionable insights, strengthening the organization’s overall security posture. Implementing data detection and response (DDR) technologies within this integrated framework further enhances these capabilities. Advanced DDR systems actively monitor and analyze data flows in real time, detecting anomalies and responding to them swiftly to protect sensitive information from internal and external threats. By embedding DDR within a well-coordinated security infrastructure, financial organizations can ensure a dynamic, responsive defense mechanism that adapts to the evolving threat landscape.

Layers of Control

In building a robust security framework, it is essential to incorporate layers of control that provide overlapping defense mechanisms. This approach recognizes that no single control can guarantee absolute security, as vulnerabilities can exist even in the most robust measures. By implementing multiple layers of defenses, organizations create additional barriers that cybercriminals must overcome, making it significantly more challenging for them to breach the system. Even if one control, such as a firewall, is bypassed, additional layers are in place to impede the progress of attackers.

The goal of security is not to make an organization impervious to breaches but to increase the difficulty level for potential attackers. Overlapping controls enhance the resilience of the IT infrastructure by continually raising the challenge for adversaries and increasing the likelihood of detection and prevention.

Prevention to Meet Compliance

Implementing preventive solutions is crucial for organizations to meet compliance mandates effectively. These solutions fulfill the required controls and demonstrate a proactive approach to security, which is particularly important for regulations such as the Sarbanes-Oxley Act (SOX). By implementing robust preventive measures, organizations can significantly reduce the risk of a security breach and accidental data disclosure, thus ensuring ongoing compliance.

Studies have shown that the cost of implementing comprehensive security measures is often about 10% of the potential financial and reputational damage caused by managing a breach and the accompanying penalties. Taking a preventive stance helps organizations avoid the substantial costs and negative consequences associated with non-compliance and data breaches while fostering a culture of continuous improvement in security practices.

DDR Protects Sensitive Data

DDR technologies play a crucial role in safeguarding sensitive data within financial organizations by leveraging advanced detection mechanisms and protective actions to prevent data loss. DDR employs a comprehensive suite of tools, including machine learning algorithms and pattern detection, to continuously monitor and analyze data flows. This allows identifying unusual activities that could signify potential security threats or breaches.

Central to the DDR approach are techniques such as masking, tokenization, and anonymization, which are employed to protect sensitive data while maintaining its utility for business operations. Masking is an efficient way to hide sensitive or privileged information by replacing names, numbers, characters, and any chosen information with asterisks, zeros, and so forth, ensuring the original data is no longer available to select locations and individuals. Tokenization replaces sensitive data elements with non-sensitive equivalents, known as tokens, which can be used in the organizational ecosystem without risking the original data. On the other hand, anonymization irreversibly alters data to remove personal identifiers, ensuring that the information cannot be linked back to an individual. These techniques help prevent the unauthorized access and loss of critical data and ensure compliance with stringent regulatory requirements by protecting personally identifiable information (PII) from exposure.

Exceeding Compliance

Achieving compliance is merely the initial phase in the fight against cyber attacks. Organizations must go beyond compliance and seek tailored solutions that effectively address their specific risks.

Improving Compliance & Preventing Breaches with Votiro

For financial organizations, maintaining compliance with stringent data protection regulations is essential. Votiro, a trusted partner to industries ranging from financial services to healthcare to shipping & logistics, delivers Zero Trust Data Detection and Response that integrates seamlessly into existing infrastructure to proactively defend against file-based threats. This integration, complemented by Votiro’s sophisticated data analytics, enables comprehensive security measures that protect employees, customers, and the organization’s reputation from digital threats that can expose data while adhering to regulatory requirements.

Votiro further strengthens its data protection suite by incorporating content disarm and reconstruction (CDR) and optional antivirus (AV) capabilities. These enhancements boost security and provide auditable tracking of unknown threats as they are neutralized, a critical feature for financial institutions required to demonstrate due diligence in threat management. By leveraging Votiro’s solutions, financial organizations can meet their performance demands and achieve a measurable return on investment (ROI), ensuring compliance with industry regulations and safeguarding sensitive customer data against various digital risks.

Votiro is designed for rapid implementation, using an API-centric solution that seamlessly integrates into existing business workflows, enabling immediate protection against cyber threats in the tools and solutions already in use at your organization. Implementation times are impressively short, with SaaS installations taking as little as 10 minutes and on-premises installations taking just 90 minutes.

Contact us today to learn how Votiro sets the bar for addressing hidden threats in files to keep your organization secure while maintaining compliance. You can also skip right to a free 30-day trial of Votiro!

News you can use

Stay up-to-date on the latest industry news and get all the insights you need to navigate the cybersecurity world like a pro. It's as easy as using that form to the right. No catch. Just click, fill, subscribe, and sit back as the information comes to you.

Sign-up Here!

Subscribe to our newsletter for real-time insights about the cybersecurity industry.